The Venture Capital Ecosystem in Mexico 2024: Sustaining Notable Growth

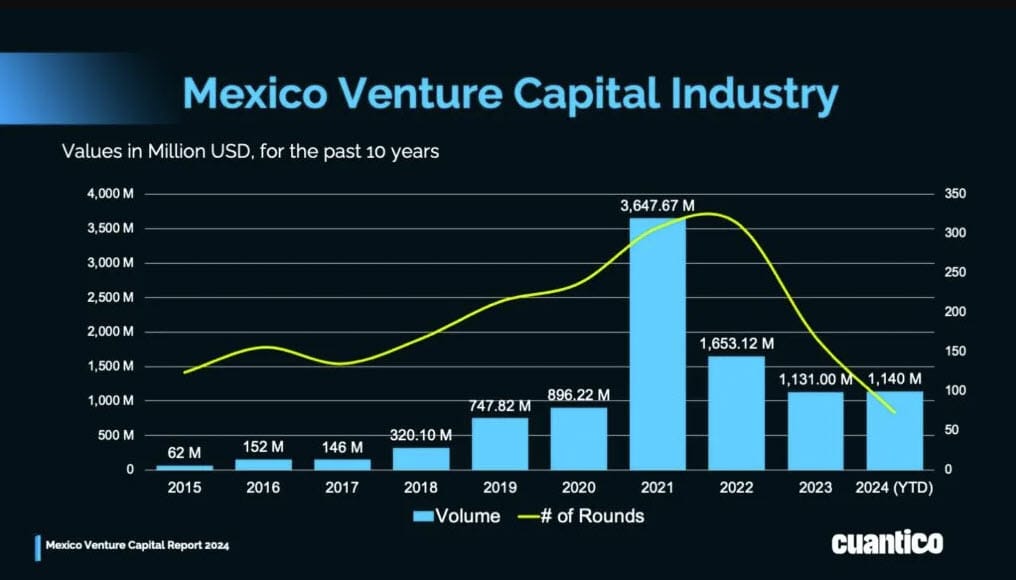

The Mexico Venture Capital Report 2024 by Cuantico illustrates the growth of venture capital in Mexico, with $9.89 billion raised to date.

Mexico’s venture capital ecosystem in 2024 continues its remarkable growth trajectory, having amassed nearly $10 billion over the last decade. According to Cuantico’s Mexico Venture Capital Report 2024, the industry has attracted both local and international investors, solidifying Mexico’s position in the Latin American market. This report, in collaboration with Startuplinks and the Central America Angel Fund Initiative (CAFI), provides a detailed analysis of trends, leading sectors, and the future outlook for venture capital in the country.

The resilience of the Mexican market is evident as, despite a decrease in the number of deals, investment volume has maintained stability, largely driven by large-scale rounds in sectors such as fintech and retail.

Mexico: A Prime Venture Capital Destination in LATAM

Mexico has become a strategic venture capital hub in Latin America, raising $9.89 billion across 1,897 funding rounds since 2015. At the regional level, the country represents 18% of all deals, second only to Brazil. This progress reflects the confidence of over 480 investors in the Mexican ecosystem, who see the country as an attractive opportunity for innovation and business expansion projects.

Jose Kont, director of Cuantico, highlighted the diversity and strength of Mexican startups, describing them as a critical pillar of the region's innovation economy.

Fintech Leads Mexico’s Venture Capital in 2024

A significant highlight from the report is fintech’s central role, accounting for 60% of venture capital investment between 2022 and 2024. Other sectors, including Autotech, RetailTech, and LogTech, have also shown strong growth, indicating a diversification in fund allocation within the innovation ecosystem.

Despite global economic challenges, such as inflation and increased competition, interest in investing in Mexican startups continues to grow, with a preference for larger rounds that enable companies to consolidate their growth.

Outlook and Key Metrics for the Future

The Mexico Venture Capital Report 2024 reveals a wide range in the size of venture capital investments in Mexico. The average minimum ticket size is $50,000, while the average maximum size reaches $300,000.

For larger rounds, amounts can go up to $1.6 million, with valuations reaching up to $8 million per investment. Additionally, the average size of venture capital funds in Mexico is $10.5 million, underscoring these funds’ commitment to developing high-innovation sectors within the country.

Cuantico’s report details the growth and maturity of the venture capital ecosystem in Mexico, highlighting both the volume of capital raised and the variety of sectors benefiting from it. With a steady flow of investment in strategic sectors like fintech and autotech, Mexico is positioning itself as a key player in Latin American venture capital.

In collaboration with Startuplinks and CAFI, Cuantico offers this report as an invaluable resource for investors and entrepreneurs interested in Mexico’s growth potential. Market dynamics suggest that venture capital will continue to play a vital role in the Mexican economy, fostering innovation and competitiveness throughout the region.

To access the full report, follow this link.