The Venture Capital Landscape in Peru for 2024

Venture Capital in Peru is set for significant growth in 2024. Local startups are increasing their capital raising efforts.

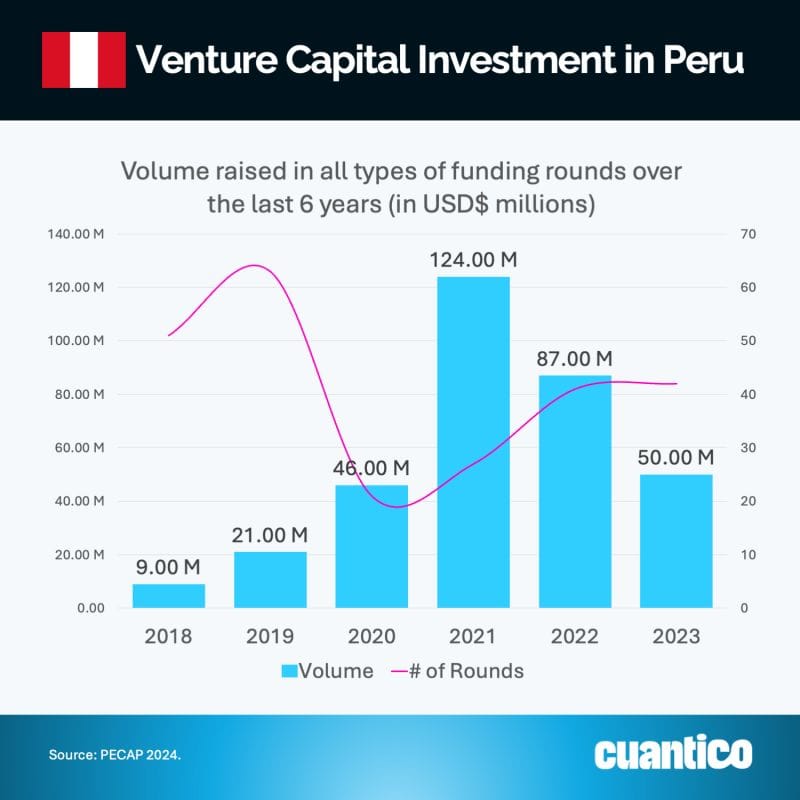

Venture Capital in Peru is set for a significant recovery in 2024, driven by growing interest from local investors and the maturing ecosystem. Although 2023 was a tough year, with a 43% drop in investment volume, the outlook for the coming year is more promising.

According to recent data, the capital raised by Peruvian startups shows signs of stabilization. Funding rounds are expected to increase in 2024, particularly in strategic sectors such as fintech and emerging technologies.

Recovery and Growth of Venture Capital in Peru

2023 was a challenging year for startups in Peru, with a substantial drop in investment volume, totaling $50 million—a 43% decrease compared to the previous year. Despite this setback, the ecosystem maintained its dynamism, with 42 startups securing investments. While modest, this number represents a slight increase compared to 2022.

Throughout the year, a shift in investor preferences was observed, with more emphasis on debt transactions, accounting for 81% of total investments. This trend was driven in part by economic uncertainty, which affected early-stage startup investments, such as pre-seed rounds, which fell from 9 to 4 within a year.

The fintech sector stood out, attracting 58% of total investments, solidifying its role as the primary growth engine in the Peruvian startup ecosystem.

Key Trends and the Role of the Fintech Sector

Fintech has been crucial in sustaining momentum for Peruvian startups throughout 2023. This sector attracted the largest share of investments, representing 58% of the total capital raised. The trend of financing through debt within this sector will continue to be important in 2024, especially given the need for financial inclusion and the regional expansion potential that these companies offer.

Looking ahead to 2024, there is a greater diversification of sectors, with industries such as foodtech, edtech, and logistics gaining traction. These industries, along with fintech, are expected to play a pivotal role in the consolidation of the Peruvian startup ecosystem, attracting both local and international investors.

Larger Rounds and Ecosystem Consolidation

Peru’s Venture Capital ecosystem is showing clear signs of maturity, with an increase in local investor participation, rising from 16% in 2022 to 39% in 2023. This shift reflects growing confidence in Peruvian startups, which are better positioned to attract larger funding rounds.

Despite global economic challenges, Peru’s Venture Capital ecosystem has demonstrated resilience. While 2023 was a difficult year, the outlook for 2024 is more optimistic, with an increase in capital raising driven by the consolidation of mature startups and fintech’s leadership. The diversification into emerging sectors, combined with greater participation from local and international investors, sets the stage for a year of growth and new opportunities in Peru’s entrepreneurial ecosystem.